in·jec·tion (n-jkshn) n. 1. The act of injecting. 2. Something that is injected, especially a dose of liquid medicine injected into the body. 3. Mathematics A function that is one-to-one. |

In der andauernden Währungsdiskussion über den unterbewerteten Yuan geht China nun in die Offensive. Führende Industrienationen, vor allem die USA, hatten seit längerem eine Aufwertung der chinesischen Währung verlangt, um die globalen Ungleichgewichte zu reduzieren.

China kontert jetzt, die US-Wirtschaftspolitik trage hieran selbst Schuld und leiste zugleich einen nennenswerten Beitrag zur Überhitzung der chinesischen Wirtschaft. Die USA überfluteten die globalen Märkte mit Cash, der auch in den chinesischen Markt fließe, die Zinsen niedrig halte und das dortige Wachstum übermäßig begünstigte.

Die Vorwürfe Chinas könnten ein Versuch sein, den globalen Fokus vom Yuan auf die Geldpolitik der USA zu richten, obwohl die Federal Reserve die Leitzinsen in den vergangenen beiden Jahren um mehr als vier Prozentpunkte erhöht hat. Einige Analysten halten die Argumente der Chinesen jedoch für gerechtfertigt. Richtig oder nicht, Chinas Einwände dürften auf den verschiedenen multilateralen Treffen im kommenden Monat diskutiert werden. Im September finden im asiatischen Raum die Konferenz der Finanzminister der APEC, der G-7-Gipfel und die Jahrestagung des Internationalen Währungsfonds statt.

Die USA und andere Industrieländer dürften China bei diesen Veranstaltungen auffordern, eine stärkere Aufwertung des Yuan zuzulassen, um einen Beitrag zur weltwirtschaftlichen Stabilität zu leisten. Der unterbewertete Yuan gebe China einen unfairen Handelsvorteil, lautet der allgemeine Vorwurf. Einige Beobachter sehen diese Unterbewertung bei bis zu 60 Prozent. China dürfte im Gegenzug auf die bereits in diesem Jahr ergriffenen Maßnahmen verweisen, so die Straffung der geldpolitischen Rahmenbedingungen und verschiedene Schritte zur Liberalisierung des Kapitalverkehrs. Damit will China einerseits die eigene Wirtschaftsdynamik dämpfen und andererseits den internationalen Forderungen entgegenkommen.

Überliquidität des Dollar.

Am deutlichsten formulierte jüngst der Bankenregulierer Yu Xuejun die Vorwürfe gegen die USA. Ursache für die Überhitzung der chinesischen Wirtschaft sei die „Überliquidität" des Dollar, sagte Yu. Die „lockere Geldpolitik" der USA von Anfang 2001 bis Mitte 2004 habe zu global überhöhten Vermögenspreisen geführt und die starken Kapitalströme in die chinesischen Wirtschaft verursacht. Diese Entwicklung habe zugleich zur Aufblähung der chinesischen Währungsreserven beigetragen - das Land hält mittlerweile weltweit den größten Bestand an Reserven. Yu gehört zwar nicht zu den wirtschaftspolitischen Entscheidungsträgern, seine Meinung könnte jedoch Chinas neue Taktik in der Währungsdebatte widerspiegeln.

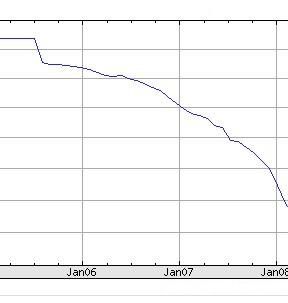

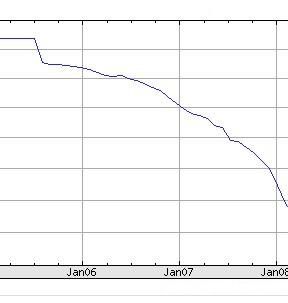

China hatte erst im Juli 2005 die heimische Währung von der Dollar-Bindung gelöst und damit die Märkte überrascht. Dabei wurde der Yuan gegenüber dem Dollar um 2,1 Prozent aufgewertet und an einen Währungskorb gebunden. Seither hat der Yuan trotz des hohen Handelsüberschusses von 134 Milliarden Dollar im Jahr 2006 um lediglich 2 Prozent zugelegt, da China durch Interventionen eine stärkere Aufwertung unterbindet. In den letzten Monaten hat sich der Überschuss von Rekord zu Rekord bewegt und dürfte bis Jahresende sogar 150 Milliarden Dollar betragen.

Renminbi revaluation just 'first small step'

By Dave Shetlock

Currencies were the focus for financial markets this week as investors digested news that China was revaluing the renminbi and the latest words of wisdom from Alan Greenspan, the Federal Reserve chairman.

Currencies were the focus for financial markets this week as investors digested news that China was revaluing the renminbi and the latest words of wisdom from Alan Greenspan, the Federal Reserve chairman.

By contrast, equities were little moved over the week with markets for the most part brushing aside another series of terrorist incidents in London. China announced it was revaluing the renminbi by 2.1% against the dollar and said it would replace its peg to the US unit with a basket of currencies. The move was given a mixed response by analysts.

"We view this as a positive event for the global economy and for equity markets and one that reinforces our bullish cyclical calls across the region on the back of improving global industrial activity," said Goldman Sachs. But Steve Barrow, currency economist at Bear Stearns, said the move was very much in line with expectations.

"In this regard, it is not a big deal," he said. "It is more like the first small step on the long path to significant renminbi appreciation."

"The main conclusion as far as we are concerned is that, if the US wants this change to result in a lower dollar/renminbi, it will have to accept, or even encourage, a weaker dollar against other major currencies such as the euro and yen."

The greenback duly tumbled against the yen before staging a modest recovery yesterday. The yen made strong gains against sterling and the euro. Analysts said the yen would benefit from expectations that a strong renminbi would prompt other Asian countries to allow their currencies to appreciate, boosting Japanese competitiveness.

US Treasury bonds also suffered a sharp sell-off following the news from Beijing, with analysts suggesting the revaluation could weigh on Chinese purchases of US bonds.

The yield on the 10-year Treasury bond drifted back yesterday but was still up sharply from levels seen at the start of the week. Bond yields were also pushed up by the other big market event of the week -Mr Greenspan's midweek testimony on monetary policy to Congress.

He gave an upbeat assessment of the US economy and confirmed that, as expected, interest rates would continue to be raised to keep inflation at bay. The question of how high the US central bank raises borrowing costs is one of the uncertainties facing the market, particularly with increasingly robust US house prices fuelling consumer spending.

Ian Harwood, global head of economics and strategy at Dresdner Kleinwort Wasserstein, believes it is very unlikely that rates will be raised specifically to deflate home prices. "The Fed didn't act thus vis-a-vis the late 1990s equity bubble and, crucially, subsequently argued it was right to behave as it did," he said.

"Fed officials, moreover, continue to deny the existence of a housing bubble, though, interestingly, they are now talking in terms of 'froth'."

World equity markets put in mixed performances. Wall Street was little changed over the week as the quarterly US reporting season got into full swing. By midday yesterday, the Dow Jones Industrial Average was down 0.3% while the S&P 500 was up slightly.

The Nasdaq Composite index inched up 0.6% following positive earnings news from the technology bellwether IBM.

European stocks touched a three-year high on Tuesday but subsequently retreated to end the week virtually unchanged. In Asia, Tokyo's Nikkei 225 Average slipped 0.5% . Car stocks fell back sharply yesterday following the renminbi's revaluation.

Elsewhere in the region Australian and Indonesian shares hit record highs, while Singapore was boosted by a loosening of restrictions on property lending.

Oil prices fell steadily through the week before staging a modest rebound yesterday.

Another large build in US distillate inventories plus a weakening of Hurricane Emily were behind the drop in crude prices.

China succeeds where Greenspan failed

By Richard Beales in New York

In the end, the People's Bank of China achieved what Alan Greenspan could not: a ratcheting up of longer-term US Treasury yields that has held, for a day at least.

In the end, the People's Bank of China achieved what Alan Greenspan could not: a ratcheting up of longer-term US Treasury yields that has held, for a day at least.

The Chinese central bank's decision to revalue the renminbi overshadowed the 79 year-old Fed chairman's 35th and probably last semi-annual congressional testimony on monetary policy. His upbeat economic message on Wednesday -which suggested no immediate let-up in Fed funds rate hikes - eventually left the 10-year Treasury yield where it had started the week, at about 4.17% .

Meanwhile the Chinese revaluation, small as it was, sparked a Treasury- sell-off. After breaking through 4.28% at one point, buyers returned, pushing 10-year yields back around 4.23% yesterday - helped by those seeking safe investments in the aftermath of further suspected terrorist activity in London.

Many observers have attributed Mr Greenspan's "conundrum" - stubbornly low yields on longer-term Treasury bonds - partly to buying by foreign central banks, including the PBoC.

But some analysts were unconvinced. "The bond market had its typical negative reaction, which we believe is overdone," said David Rosenberg, chief economist at Merrill Lynch. He saw no reason for central bank buying of Treasuries to decline, and said US government bond yields were driven more by domestic inflation fundamentals.

"There is not a shred of evidence this revaluation .or even future moves will prove to be inflationary," he said. But Mr Greenspan's testimony and the minutes of the last Federal Open Markets Committee - released on Thursday - pointed to some inflationary concerns for the future, said Alan Ruskin, research director of 4Cast, the economic consultancy. Meanwhile, government bond prices in Germany were higher and yields lower on the week yesterday.

Mark Watts, head of global fixed income at Morley Fund Management, said the Chinese move to link the renminbi to a basket of currencies rather than the dollar alone could increase demand for European government debt. That view was about 6 basis points lower on the week at 3.23% . The difference between US and German 10-year yields reached a full percentage point, the widest gap in at least five years.

Low eurozone yields partly reflect a weak economic outlook, and still imply a small chance of a central bank rate cut. said Mr Watts. Recent data have been slightly more positive, he said, and if that trend continues the gap between US and eurozone yields could narrow again.

"European bond [prices] are vulnerable to a repricing of growth expectations upward." he said.

China cools hopes of rising renminbi

By Mure Dickie in Beijing

China kept its newly unpegged and revalued currency on a tight rein yesterday, the renminbi ending the day slightly lower against the dollar. The decline appeared intended by Beijing to cool hopes that the policy change would open the way to the kind of significant appreciation demanded by Washington. US critics say the renminbi is undervalued by 20% and gives China an unfair trade advantage.

China kept its newly unpegged and revalued currency on a tight rein yesterday, the renminbi ending the day slightly lower against the dollar. The decline appeared intended by Beijing to cool hopes that the policy change would open the way to the kind of significant appreciation demanded by Washington. US critics say the renminbi is undervalued by 20% and gives China an unfair trade advantage.

In its first day of trade after Thursday's 2.1% revaluation against the dol lar, the renminbi slipped to 8.1111 from its opening of 8.1100.

Although the new mechanism allows the renmimbi to rise or fall up to 0.3% against the dollar each trading day, China's domestic currency market is dominated by the People's Bank of China, the central bank, with other traders playing a relatively minor role.

However, international investors yesterday still expected further rises: in Singapore, one-year renminbi non-deliverable forwards rose to around 7.64 per dollar, a level that predicts further revaluation of over 6% by the middle of next year. Chinese stocks rose and shares of Asian exporters fell by magnitudes that also suggested expectations of a further renminbi appreciation.

Merrill Lynch, the US investment bank, forecast that the renminbi would rise to 7.5 to the dollar by the end of this year, while Bank of America saw the renminbi being held at 8.11 to the dollar until the year-end. BNP Paribas believed Beijing would allow the renminbi to firm to 7.9 by December.

Separately, in early trading in London yesterday, eurozone government bond prices surged to a five-year high relative to US Treasury prices, as some investors concluded that Asian central banks would buy fewer US government bonds in future.

Within China, expectations of future currency moves were seen as likely to fuel a renewed inflow of speculative funds by companies and individuals who can find ways around the country's capital controls.

However, Xia Bin, director general of the Financial Research Institute under the State Council, China's cabinet, warned speculators against harbouring "illusions" about further revaluation, saying no "clear" appreciation was likely in the remainder of this year.

Asian currencies, with the notable exception of the Indian rupee and the Japanese yen, recorded widespread gains yesterday on the back of the revaluation of the renminbi.

The currencies of South Korea, Taiwan and Singapore were among the bigger beneficiaries of capital inflows as investors focused on their trade links with China. However, the rises prompted market talk that central banks were intervening to cap any gains. With exports accounting for a large part of the economic growth of many Asian countries, monetary authorities are expected to counter any large rises in their currencies.

South Korea's finance minister Han Duck Soo was quoted as saying that the authorities would "take preemptive and strong steps when there is instability in the financial market".

Talk of central bank intervention was behind the slide in the Indian rupee - the biggest daily fall among the world's currencies - after it recorded the biggest rise in seven months on Thursday amid hopes Indian exporters would gain an edge over their Chinese rivals.

The yen also reversed part of yesterday's gains as investors focused on the threat of intervention. In Japan, a chorus of positive comments from politicians about China's measured revaluation

failed to quell investors' fears that a stronger yen and a weaker dollar would undermine the country's exporters and the Nikkei 225 benchmark dropped 0.76% as a result.

But having strengthened sharply after the announcement, the yen weakened during the course of the day as analysts and investors concluded the revaluation brought many benefits to Japanese companies.

The Malaysian ringgit, pegged at M$3.8 to the US dollar until Thursday, when the government announced a managed float in tandem with China's revaluation, rose a modest 0.7% yesterday to close at 3.7750-3.7800 to the US dollar.

The Taiwan dollar closed up 0.95% at 31.648 to the US dollar. "That is the

pattern the central bank wants to see," said a Japanese bank currency trader in Taipei.

Analysts expected the revaluation of the renminbi to trigger another wave of speculative fund flows into Hong Kong, whose currency is considered a proxy for the Chinese currency.

Peter Mandelson, the European Union trade commissioner, yesterday said he did not expect the revaluation to have an immediate impact on trade flows, but welcomed it as a step in the right direction.

Additional reporting by Justine Lau in Hong Kong, Kath-rin Hille in Taipei, Gillian Tett and Steve Johnson in London and Tobias Buck in Brussels

Malaysia to rely on central bank in ringgit float

By John Burton in Singapore

Malaysia revealed yesterday that it would rely on central bank intervention rather than a currency trading band to maintain the stability of its managed float of the ringgit.

Malaysia revealed yesterday that it would rely on central bank intervention rather than a currency trading band to maintain the stability of its managed float of the ringgit.

The ringgit's float against a trade-weighted basket of foreign currencies would differ from that of China, which will set a daily trading band of plus or minus 0.3% for the renminbi.

Malaysia announced last week that it would be dropping its currency peg against the US dollar in tandem with a similar decision by China. China's new currency systern adheres more closely to that of Singapore, which has used a secret policy band to guide its managed float of the Singapore dollar against a foreign currency basket.

Chinese authorities have acknowledged that they studied the Singapore currency model, introduced in the early 1980s, before the recent revaluation.

Nor Mohamed Yakcop, Malaysia's second finance minister, said the central bank would intervene if there was "undue volatility", but the government preferred to rely on market factors to determine the ringgit's value. A ban on offshore trading of the ringgit will also help Malaysia to keep control of its value and protect it from speculators.

Malaysia was "very well-equipped" to intervene against a speculative attack on the ringgit since it had US$75bn (€57bn, £44bn) in reserves, said Mr Nor, who was one of the main architects of Malaysia's move in 1998 to adopt a fixed-exchange rate in the wake of the Asian financial crisis.

"We have to give some time for [the managed float] to work, some time for the market to adjust," he said.

"But certainly the exchange rate should reflect [economic] fundamentals."

The ringgit, which had been fixed at MS3.8 to the US dollar, gained 0.7% against the greenback on Friday in its first day of trading under the new system.

Analysts said the ringgit's modest rise was primarily due to central bank intervention and the ban on offshore trading.

The ringgit has been seen by economic analysts as 5-10% undervalued against the dollar, with some traders predicting it could appreciate by up to 5% by the end of the year.

The disclosure of details about Malaysia's managed float could attract new speculative inflows into the country's equities and bonds in anticipation of further currency appreciation.

The Kuala Lumpur stock market on Friday rose to a five-year closing high and foreign investors bought local treasury bills, reducing short-term yields.